In the grand tapestry of life, few things hold as much significance as the sanctuary we call home and the cherished loved ones who reside within its walls. Yet, amidst the hustle and bustle of daily existence, it's easy to overlook the importance of fortifying this bastion of security against the unpredictable winds of fate. This is where the often-underestimated shield of life insurance steps into the spotlight, offering a vital layer of protection for homeowners and their families.

Understanding the Risks

Potential Threats to Homeownership

Owning a home is a cornerstone of the American dream, but it comes with its own set of risks. From natural disasters to unexpected health crises, the journey of homeownership is fraught with potential pitfalls that can threaten its stability. While we may diligently safeguard our homes against physical perils, it's equally crucial to prepare for the financial storms that may loom on the horizon.

Impact of Unforeseen Circumstances

Life, with all its twists and turns, is inherently unpredictable. A sudden illness, the untimely passing of a breadwinner, or an unforeseen job loss can upend the delicate balance of family life in the blink of an eye. Without adequate preparation, such events can leave families grappling not only with emotional upheaval but also with financial turmoil, jeopardizing their ability to keep a roof over their heads and maintain their quality of life.

The Role of Life Insurance

Definition and Purpose

At its core, life insurance is a contractual agreement between an individual and an insurance company, wherein the insurer provides a lump-sum payment, known as a death benefit, to the designated beneficiaries upon the insured's death. This financial lifeline serves as a crucial safety net, offering peace of mind and ensuring that loved ones are shielded from the potentially devastating impact of financial instability in the event of the insured's passing.

Safeguarding Homeowners and Their Families

For homeowners, life insurance serves as a powerful tool for safeguarding both their most valuable asset—their home—and the well-being of their loved ones. By providing a financial cushion to cover mortgage payments, living expenses, and other ongoing financial obligations, life insurance ensures that families can weather the storm and keep their homes intact, even in the face of adversity.

Different Types of Life Insurance Policies

Life insurance policies come in various forms, each offering its own set of features and benefits tailored to meet the diverse needs of policyholders. Term life insurance provides coverage for a specified period, offering a cost-effective solution for short-term needs, such as paying off a mortgage. Whole life insurance, on the other hand, offers lifelong coverage with an added investment component, providing both protection and potential cash value accumulation over time.

Advantages for Homeowners

Financial Protection for Mortgage Repayment

For many homeowners, the mortgage represents their single largest financial obligation. In the event of the insured's death, a life insurance policy can ensure that the outstanding mortgage balance is paid off, allowing the surviving family members to remain in their home without the burden of monthly payments hanging over their heads.

Inheritance tax planning

After your passing, your loved ones face the daunting prospect of dealing with inheritance taxes on your estate. It's not just about the emotional weight; there's a financial burden, too. However, you can significantly ease this burden with a good life insurance strategy.

You can take out a whole-of-life cover, say £100,000, specifically earmarked to cover inheritance tax obligations. This means that the payout from your life insurance policy can be used directly to settle any inheritance taxes due, ensuring that your beneficiaries receive more of what you intended for them.

But a clever trick called 'writing in trust' can supercharge your inheritance tax planning. By placing your life insurance policy in trust, you effectively remove it from your estate for inheritance tax purposes. This means that the payout from the policy goes directly to the beneficiaries you nominate, bypassing the probate process and the associated delays. Plus, it could lead to significant tax savings, potentially saving your loved ones from paying up to 40% on the value of your estate.

Of course, setting up a life insurance policy in trust involves some legal and tax considerations, so it's essential to seek financial and legal advice to ensure everything is structured correctly. But the benefits, both in terms of financial security and tax savings, can be substantial, making it a smart move for anyone looking to protect their legacy and provide for their loved ones even after they're gone.

Covering Ongoing Living Expenses

Beyond mortgage payments, life insurance can also help cover the day-to-day living expenses of the surviving family members, from utility bills to groceries to childcare costs. By providing a steady stream of income in the absence of a primary earner, life insurance ensures that families can maintain their standard of living and preserve their financial stability during challenging times.

Ensuring the Continuity of Children's Education and Future Plans

For parents, one of the greatest concerns is ensuring that their children have access to quality education and opportunities for a bright future. In the event of the insured's passing, life insurance can provide the necessary funds to cover tuition fees, college expenses, and other educational costs, ensuring that children can pursue their dreams without financial constraints holding them back.

Tailoring Coverage to Specific Needs

Assessing Individual Homeowner Circumstances

No two homeowners are alike, and neither are their insurance needs. When it comes to life insurance, it's essential to take a personalized approach, carefully assessing the unique circumstances and financial goals of each individual or family. Factors such as age, income, outstanding debts, and future aspirations should all be taken into account when determining the appropriate level of coverage.

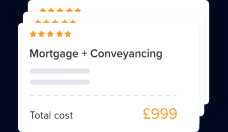

Customizing Life Insurance Plans

Fortunately, life insurance offers a high degree of flexibility, allowing homeowners to customize their coverage to suit their specific needs and preferences. Whether you're looking for basic protection to cover mortgage payments or seeking comprehensive coverage to safeguard your family's long-term financial security, there's a life insurance policy to fit every budget and lifestyle.

Long-term Financial Security

Building a Safety Net for Unexpected Events

Life is full of uncertainties, but with the right safeguards in place, families can rest assured knowing that they're prepared for whatever the future may hold. By building a robust financial safety net through life insurance, homeowners can protect their homes, secure their legacies, and ensure that their loved ones are provided for, no matter what twists and turns lie ahead.

Securing the Family's Financial Future and Legacy

Ultimately, life insurance is about more than just dollars and cents—it's about preserving the intangible legacy of love, security, and stability that homeowners strive to leave behind for their families. By securing adequate life insurance coverage, homeowners can rest easy knowing that their loved ones will be taken care of, allowing them to focus on building cherished memories and enjoying the precious moments that life has to offer.

Conclusion

In the ever-changing landscape of life, one thing remains constant: the importance of safeguarding our homes and protecting our families against the uncertainties of tomorrow. Through the powerful tool of life insurance, homeowners can fortify their financial foundations, ensuring that their homes remain beacons of security and stability for generations to come. So, take the time to assess your insurance needs, explore your options, and take proactive steps to protect what matters most—because when it comes to safeguarding your home and family, no substitute for the peace of mind comes from knowing you're prepared for whatever life may bring.

Make a comment